Technology is changing the world for people and pets alike. In the last decade, pet care has undergone its own digital transformation—and we’re not just talking about the proliferation of cat videos on the internet. From finding pet sitters and helping dogs cope with separation anxiety to seeking veterinary services via your mobile device, technology is helping pet parents care for and enjoy time with their four-legged friends even more.

One of dozens of industry verticals PitchBook tracks, pet technology companies are defined by their mission to enhance pet ownership and quality of life. Many pet tech startups operate as novel services and pet-related apps, like Rover and Chewy. Others exist as physical products, from digital devices to meat-free kibble.

PitchBook makes it easy to identify key players in this growing space, including the pet tech investors and brands highlighted below. Click through to our investor and company profile previews to get a better idea of the data we track.

1. Digitalis Ventures

Founded in 2016, Digitalis Ventures is a venture capital firm based in New York, New York. The firm seeks to invest in solutions to complex problems in human and animal health.

This firm has invested in Scratchpay, which matches pets and their owners to affordable veterinary care through technology that aggregates and analyzes different care providers.

2. Felicis Ventures

Founded in 2006, Felicis Ventures is a boutique venture capital firm based in Menlo Park, California. The firm seeks to invest in the mobile, e-commerce, enterprise, education and health sectors.

The firm has invested in Wild Earth, a sustainable pet food brand that contains cultured protein and no animal by-products, giving pets all their nutritional needs.

3. Boost Heroes

Boost Heroes is a venture capital firm focused on investments in firms in the early stages of development and high scalability potential. It is based in Milan, Italy.

The firm has invested in Kippy, a developer of a pet tracking device and mobile application designed to monitor activities of pets.

4. Bascom Ventures

Founded in 2017, Bascom Ventures is a venture capital firm headquartered in Chicago, Illinois. The firm is led by alumni from the University of Wisconsin and seeks to invest in companies founded by other alumni, which includes seed-stage startups, social impact and women entrepreneurs.

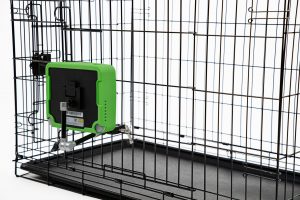

The firm invested in DogSpot, a company that offers dog houses outside of storefronts, enabling owners to keep their dog in a safe place while they shop or run errands.

5. Founder Collective

Founded in 2009, Founder Collective is a seed-stage venture capital firm based in Cambridge, Massachusetts. The firm seeks to invest in the adtech, b2b, consumer, e-commerce, devices, health and crypto sectors.

The firm has invested in Embark, a company that offers DNA testing kits for dogs. The test kit looks at more than 200,000 genetic markers to offer insights to owners about their dogs’ disease risk, inheritable traits, breed ancestry and more.

6. Collaborative Fund

Founded in 2010, Collaborative Fund is a venture capital firm that is based in New York, New York. The firm seeks to invest in the cities, money, consumer, health and kids sectors.

The firm has invested in The Farmer’s Dog, a subscription-based pet health brand which delivers balanced, ready-to-serve personalized meal plans based on dog’s individual profile including age, breed, size and activity level.

7. Structure Capital

Structure Capital is a venture capital firm that specializes in seed, early and late venture stage investments. The firm seeks to invest in companies across the media, engineering, sales, marketing, science, law and entertainment sectors. It is based in San Francisco, California and was founded in 2013.

The firm invested in Wag Labs, a dog walking mobile application intended to offer experienced and certified dog walkers instantly on the phone.

8. SOSV

SOSV is a multi-stage venture capital investor based in Princeton, New Jersey. The firm runs multiple accelerator programs, and provides seed, venture and growth-stage follow-on investments to its companies. SOSV prefers to invest in manufacturing, life sciences, healthtech, internet of things, robotics, fintech, food, AI and other sectors.

The firm has invested in Petcube, the developer of a wireless pet camera that can be used to monitor pets, as well as talk and play interactive laser games with them from anywhere using a smartphone. Other pet tech startups SOSV has invested in include Petronics, Bramble, Findster, GoBone and Spare Leash.

9. 500 Startups

500 Startups is an accelerator and venture capital firm based in San Francisco. Founded in 2010, the firm seeks to make minority seed, early-stage, and later-stage investments in media, consumer services, mobile, SaaS, fintech, and other sectors.

Among other pet tech investments, 500 Startups has funded subscription-based treat startup BarkBox and online pet boarding marketplace Holidog.com.

10. Slow Ventures

Founded in 2011, Slow Ventures is a seed-stage focused venture capital firm based in San Francisco and Boston. The firm focuses on US-based companies in consumer, enterprise, SaaS, mobile, fintech, crypto and other categories.

The firm has invested in several pet tech companies, including animal DNA testing kit Embark and on-collar activity tracker Whistle.

11. RRE Ventures

Founded in 1994, RRE Ventures is a venture capital firm based in New York, New York. The firm primarily invests in seed, Series A, and Series B rounds and focuses on companies operating in the financial services, 3D printing, media, space, and robotics sectors.

In 2018 and 2019, RRE Ventures invested in Fi, the developer of a smart dog collar that uses GPS and LTE-M to measure the steps a dog takes—for health purposes—and track its location anywhere in the US.

12. Techstars

Techstars is an accelerator and mentorship-driven seed-stage investment program. Headquartered in Boulder, Colorado, the three-month program operates in multiple US cities and in the United Kingdom annually. The firm provides access to community leaders, founders, mentors and corporate partners, allowing entrepreneurs to gain education and funding.

In June 2020, the firm invested in Petabolix—an intelligent nutrition program that provides advanced nutritional assessments and personalized diet recommendations for pets.

13. Lerer Hippeau

Founded in 2010, Lerer Hippeau is a venture capital firm based in New York. The firm seeks to invest in companies operating in the consumer, digital media, e-commerce, emerging tech and enterprise software sectors.

In 2016 and 2017, the firm invested in Ollie, the producer of ready-to-serve meals for dogs made with ingredients sourced from family-run farms and customized based on each dog’s nutritional needs.

Lire la suite: pitchbook.com